“The Saudis Are Sending Us A 50 Million Barrel Oil Bomb”

Zero Hedge: By now even the 165,727 “professional investors” who are long the USO ETF on the free, glitch-prone platform Robin Hood, are aware that the problem facing global oil production is that there is simply no storage where to put all the physical oil (as we warned in late March).

And if even the army of Robinhood-ers now know how impossible it is to find space for physical oil on the continental US, then Saudi Arabia – which sparked the current crude crisis and which will not stop until shale is completely crushed – is certainly aware.

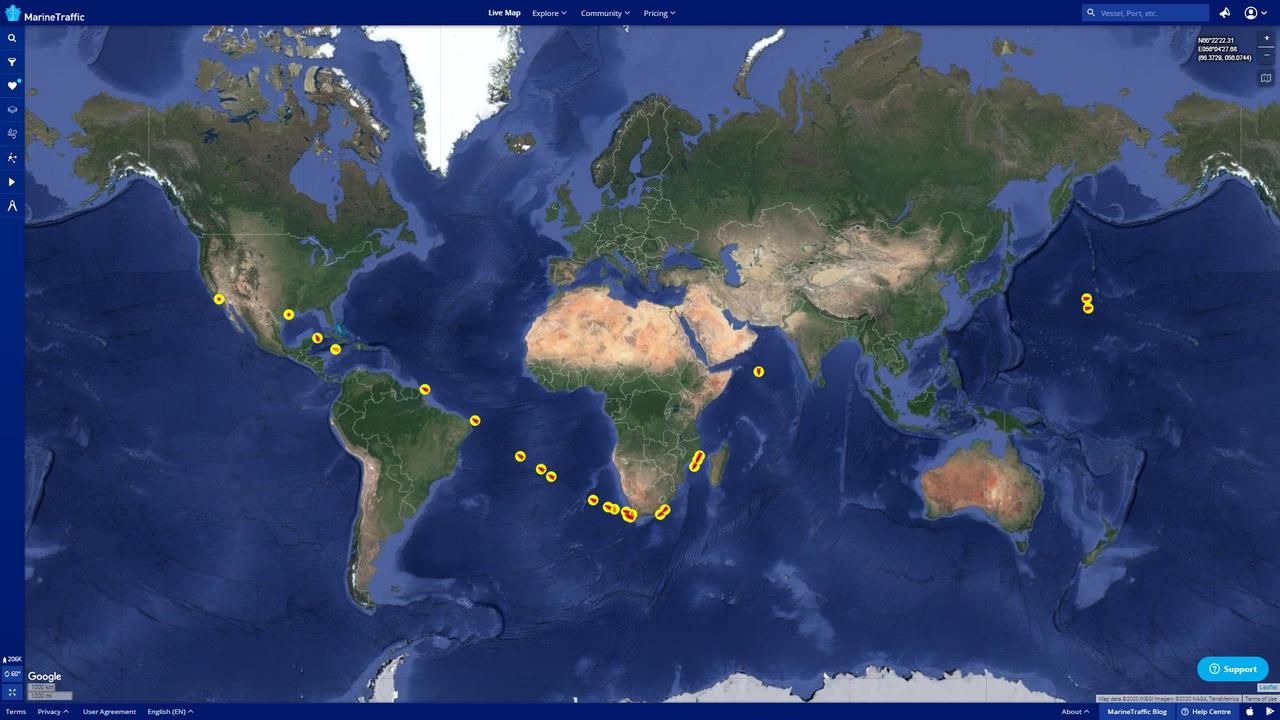

Which is why with the US unable to store its own output, some 50 million barrels of Saudi oil are on their way to the United States and due to arrive in the coming weeks, piling even more pressure on markets already struggling to absorb a glut of stocks, Reuters and Marine Traffic reported. Read More …

Opinion: Ethel, I think we are fighting a losing game!

Problem #1

While President Trump has offered to cut production, U.S. antitrust law prohibits oil companies from coordinating their production, and there is no direct mechanism for the government to dictate production levels to private oil companies.

Problem #2

Oil wells can’t simply be turned off and on like tap water. It can take weeks to shut one down – it costs lots of money to shut one down and even more money to start them up again (if they don’t fail). So oil producers have an incentive to keep production flowing, even if they are operating at a loss and, in extreme circumstances, actually paying people to take crude off their hands.

Problem #3

The Port Arthur refinery in Texas, which can process 600,000 barrels of oil per day, is completely owned by Aramco (Saudi Arabia). The change of ownership, completed in 2017, should give the oil giant the ability to pump more Saudi crude into North America.

Problem #4

There are over 100 shale producers in the US and for them to stay profitable oil needs to trade at $40 per barrel. When oil dropped to $30 per barrel, only 4 producers were still profitable. On April 1 the first U.S. shale oil producer, Whiting Oil, filed for bankruptcy.

Problem #5

The Saudis and Russians have declared war against US shale energy companies. Storage full… largest glut in history. Now the Saudis are sending us a 50 million barrel oil bomb.

Ted Cruz:

“20 tankers—filled w/ 40mm barrels of Saudi oil—are headed to the US. This is SEVEN TIMES the typical monthly flow. At the same time, oil futures are plummeting & millions of US jobs in jeopardy. My message to the Saudis: TURN THE TANKERS THE HELL AROUND”.

President Trump:

The question reached the very top on Monday, when President Trump said he would “look at” possibly stopping Saudi shipments to the United States. While it wasn’t clear what Trump had in mind, last week, Frank Fannon, the U.S. assistant secretary of state for energy resources, said tariffs were a possibility.