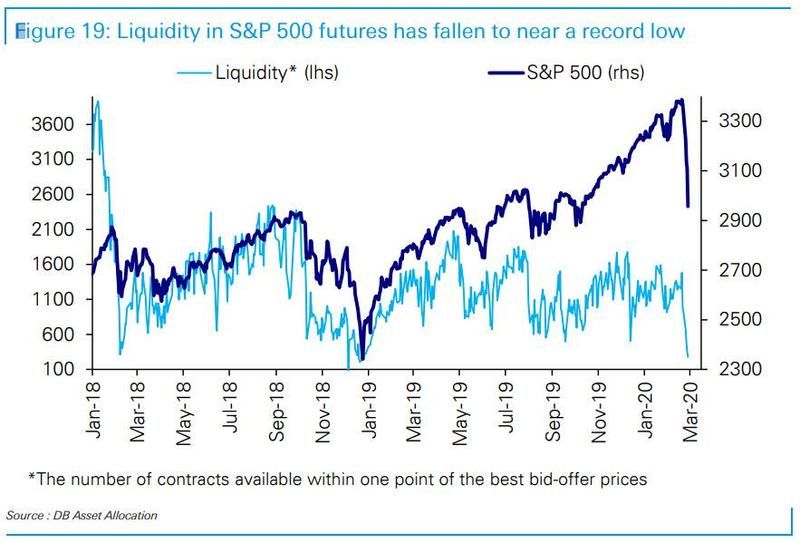

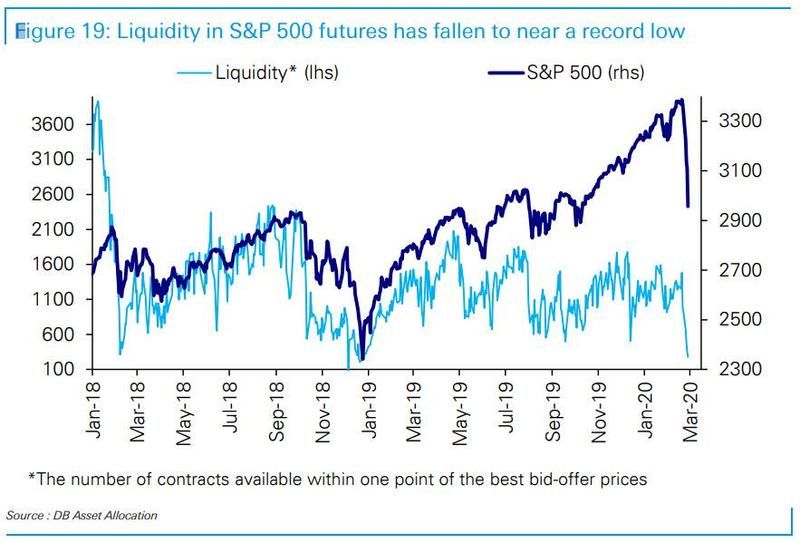

Market Liquidity Is At An All-Time Low – Calling The Fed

This content is restricted to site members. If you are an existing user, please log in. New users may register below.

This content is restricted to site members. If you are an existing user, please log in. New users may register below.