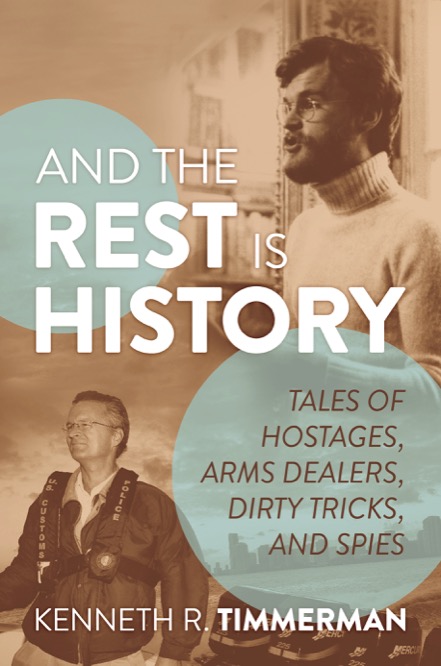

Ken Timmerman’s 12th book of non-fiction, AND THE REST IS HISTORY: Tales of Hostages, Arms Dealers, Dirty Tricks, and Spies, is now available from PostHill Press. Ken Timmerman’s 12th book of non-fiction, AND THE REST IS HISTORY: Tales of Hostages, Arms Dealers, Dirty Tricks, and Spies, is now available from PostHill Press.

AND THE REST IS HISTORY can be ordered directly from Amazon by clicking here or by viewing my author’s page, here.

– Republican nominee for Congress, Maryland District 8 (2012)

– National Security and Foreign Policy Advisory Board, Trump for President 2016

– President & CEO, Foundation for Democracy in Iran, www.iran.org

– Nobel Peace Prize nominee, 2006

Cell: 301-675-7922

Follow me on Twitter @kentimmerman

#TheElectionHeist

Facebook: ken timmerman

Reply to: kentimmerman@comcast.net

Website: kentimmerman.com |