Author: Author1

Religious Liberty Group Warns Biden Rule Would Force Trans Surgeries, Abortions

Al-Zawahiri Death Shows Al Qaeda is Back in Kabul and Taliban Deal Was Worthless

US Household Debt Surpasses $16 Trillion on Higher Mortgages

US household debt increased by 2% to $16.2 trillion in the second quarter, with mortgages, auto loans and credit-card balances all seeing sizable increases, according to a report by the New York Federal Reserve Bank.

The increase in borrowing, which equals to $312 billion over three months, reflected in part higher prices for homes and cars. Americans also are putting more on their credit cards to cover rising costs amid decades-high inflation.

“For the Lord your God will bless you just as He promised you; you shall lend to many nations, but you shall not borrow; you shall reign over many nations, but they shall not reign over you.” Deut. 15:6

The main driver was mortgage debt, which accounted for two-thirds of the rise last quarter. And the 13% jump in credit-card debt year-over-year was the sharpest gain in more than 20 years, the New York Fed said in its quarterly report on household debt and credit.

“While household balance sheets overall appear to be in a strong position, we are seeing rising delinquencies among subprime and low-income borrowers with rates approaching pre-pandemic levels,” said Joelle Scally, administrator of the Center for Microeconomic Data at the New York Fed.

Consumers added a record $100 billion in credit-card debt over the last year. But in aggregate, consumers still have plenty of room to spend with another $3.33 trillion in available credit on their cards.

Since the pandemic started, about 42 million new credit card accounts have been opened, and consumers now hold more than 750 million auto-loan, credit-card, mortgage, and home-equity lines of credit. Overall, consumers ages 30 to 59 have record levels of debt.

Overall, about $435 billion of the $16.2 trillion in debt is delinquent, and $294 billion is seriously delinquent, meaning that its at least 90 days late.

Read More @ Yahoo Finance HERE

UN and WEF Behind Global ‘War On Farmers’

Calvinism, famines, food shortages, Matthew 24, Prophecy Today, reformed Baptist, theology, tribulation, WEF

Humanity 2.0: ‘The Fusion Of Our Physical, Digital, And Biological Identities’

Big Brother in your Wallet: a Guide to the Perplexed on Israel’s New Cash Limits

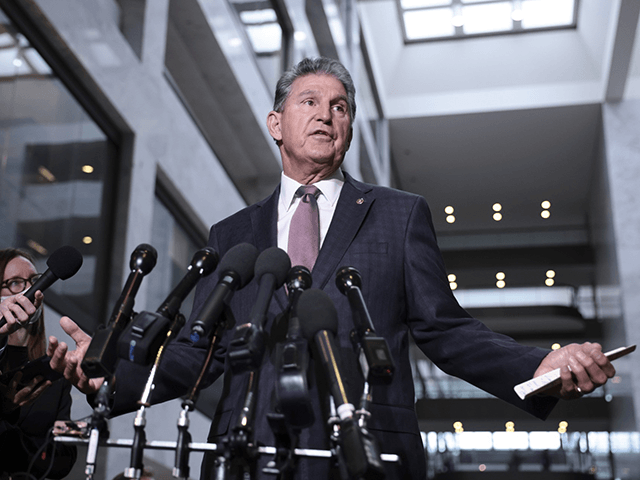

Manchin-Schumer ‘Inflation Reduction’ Bill Gimmicks Exposed, Proposal Actually Increases Spending, Inflation

China Vows ‘Targeted Military Actions’, Including Live Fire Drills Around Taiwan, As Pelosi Stays Overnight

Biden nominates pro-abortion attorney, homosexual judge for federal courts

PA to raise salaries of terrorists who bombed the Hebrew University in Jerusalem

Who is Yuval Noah Harari?

Barack Obama, Bill Gates, Klaus Schwab, Mark Zuckerberg, Satan, Sheep and Goat judgment, useless class, Youval, Yuval Noah Harari