Author: Author1

This Is What Sparked 900 point Euphoric Post-Fed Meltup

“Highly Attentive” Fed Unleashes Biggest Rate-Hike Since Bursting The Dot-Com Bubble

Congress Probes Biden Admin After Taliban Uses US Biometric Data To Target US Allies

Russia Is Returning To The Gold Standard: Is China Next?

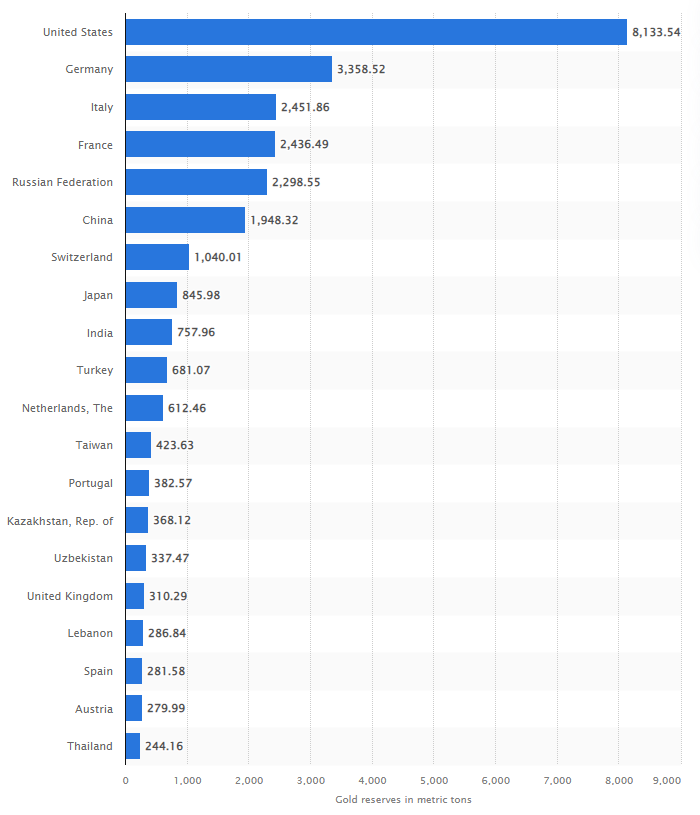

Assessment: Russia backing its currency with gold represents one of the most drastic changes to the foreign currency market in decades. As of 2022, precisely zero countries still adhere to a gold standard, though many countries still hold gold in reserve …

No sooner was it that I wrote an article talking about how Russia was going to back the ruble with gold than “one of the Russia’s most powerful security/intelligence officers and a close ally of Putin” has admitted the country’s intentions to do just that.

And I’m predicting that no sooner will the gravity of this decision finally sink in with the West that China will follow closely in Russia’s footsteps and do the same.

The new global monetary system is likely going to look like Russia, China, India, Saudi Arabia and other countries with commodity-backed, sound money on one side – and the west and our allies, with our “infinite” fiat, under the tutelage of rocket surgeon Neel Kashkari, on the other.

Despite the enormity of the situation, the news hasn’t really been digested by global markets yet.

Read More @ Zero Hedge HERE

A New Gold Standard? Kremlin Intends To Back Ruble With Gold And Commodities

EastMed pipeline, gold, Jay Powell, Keystone Pipeline, Nikolai Patrushev, Putin, ruble, US dollar, world reserve currency, Xi Jinping, yuan

With These Three Words, Biden Just Ruined Democrats’ Messaging on Abortion

Israel should share its Memorial Day when Muslims share the Temple Mount

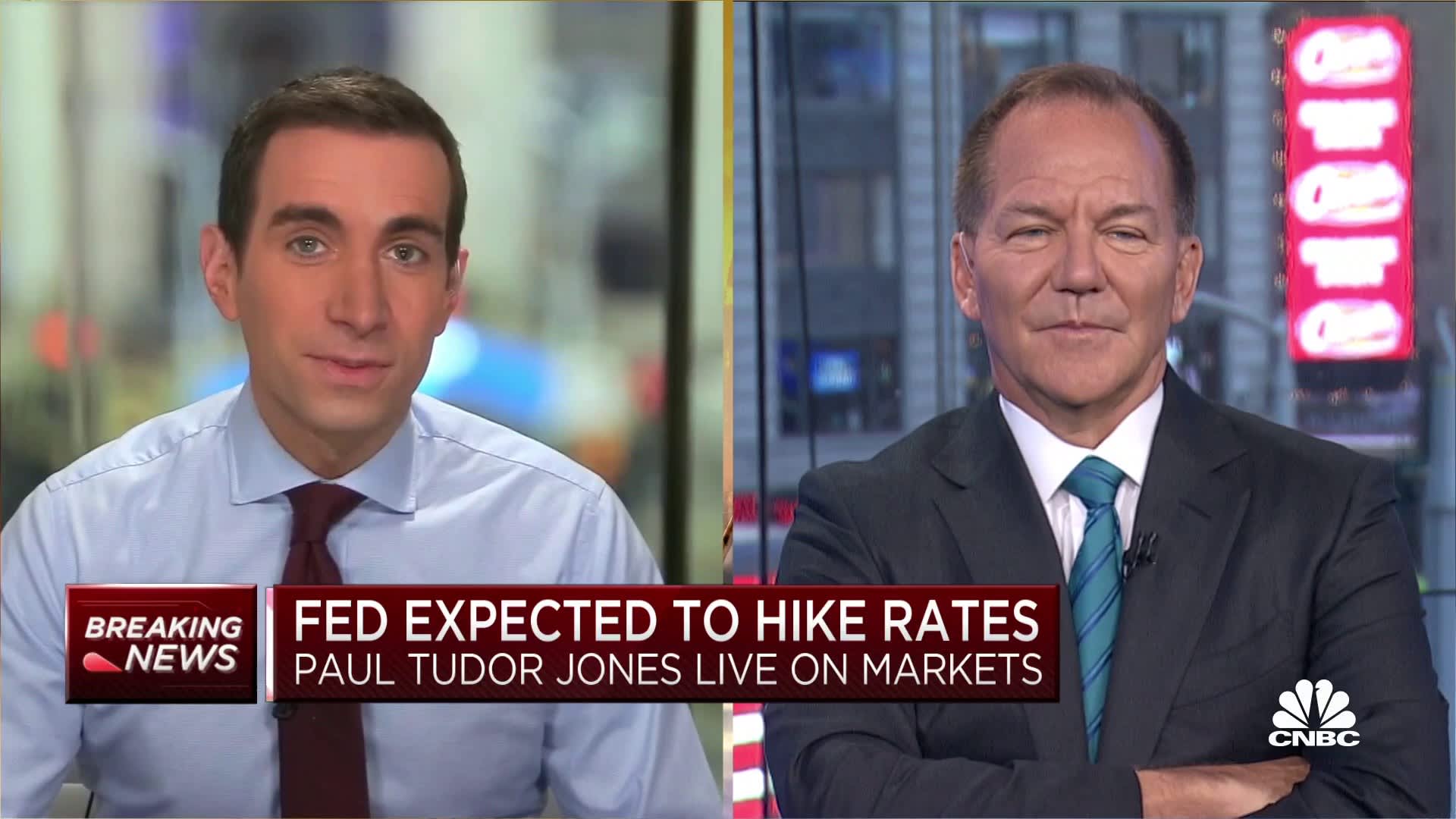

Paul Tudor Jones says he can’t think of a worse financial environment for stocks or bonds right now

Assessment: “I think we’re in one of those very difficult periods where simple capital preservation is I think the most important thing we can strive for,” Jones said

Billionaire hedge fund manager Paul Tudor Jones said the environment for investors is worse than ever as the Federal Reserve is raising interest rates when financial conditions have already become increasingly tight.

“You can’t think of a worse environment than where we are right now for financial assets,” Jones said Tuesday on CNBC’s “Squawk Box.” “Clearly you don’t want to own bonds and stocks.”

“ For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.” 1 Timothy 6:10

The Fed is expected to announce a half-percentage point increase in its benchmark interest rate on Wednesday, to tamp down surging inflation at a 40-year high.

The founder and chief investment officer of Tudor Investment believes investors are now in “uncharted territory”

Read More @ CNBC HERE