With inflation and Ukraine, Powell must thread a needle on Capitol Hill this week to calm markets

Assessment: The shifting winds mean Powell has a tightrope to walk as he explains during two days of congressional testimony that his institution is committed to taming inflation while also being mindful of the geopolitical turmoil …

- Fed Chairman Jerome Powell addresses separate House and Senate panels this week as part of biannual hearings on monetary policy.

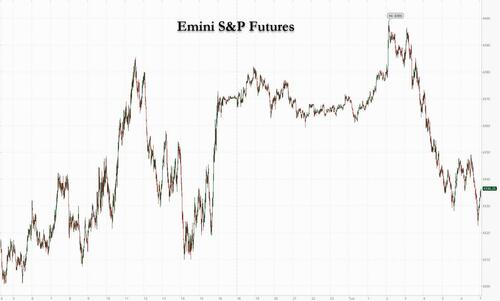

- Fears over the Russian invasion of Ukraine have coincided with markets quietly dialing down their expectations for Fed action.

- Powell will have to convince Congress the Fed is doing more to combat inflation at a time when the markets think it will be doing less.

- “The balancing act is going to be difficult,” said Mark Zandi, chief economist at Moody’s Analytics.

Federal Reserve Chairman Jerome Powell is tasked with telling Congress this week that the central bank will be doing more to control inflation at a time when markets expect it will be doing less.

With fears over the Russian invasion of Ukraine causing turmoil in the financial world, Wall Street has quietly dialed down its expectations for Fed action.

Where markets had been expecting the Fed to raise interest rates up to seven times in 2022, recent pricing now indicates just five moves. That would be the equivalent of bringing the Fed’s benchmark short-term borrowing rate up about 125 basis points, or to a range between 1.25%-1.5%.

Read More @ CNBC HERE