Author: Author1

"the fight against Hamas “must be without mercy but not without rules...

Canadian military members speak out after being told chaplains shouldn’t use ‘God’ in public prayers

CAF members who are known to LifeSite but have asked to remain anonymous spoke out...

Blinken Warns UN Of “Decisive” Action If Iran Proxies Attack Americans; Carrier Strike Groups On Alert

Missile and drone attacks on Pentagon outposts in Syria and Iraq have been rising in the last days...

Worrisome indications from Lebanon

Hezbollah leader quiet...

IDF spokesman reveals: This is the note found on the terrorist’s body

The words from Hamas commanders consist of an order to kill Jews and encouragement to decapitate...

House Republicans: Joe Biden Has No Authority to Import Palestinians to U.S. Through Parole Loophole

“no authority exists to grant categorical parole” to a group of foreign nationals...

Joel Rosenberg: Will the West Tie Israel’s Hands?

Hezbollah continues to attack Israeli military positions and civilian centers along the border with increasing ferocity...

Russian President Vladimir Putin suffers heart attack, found lying on floor: Reports

Kremlin official claimed Putin's health had sparked huge "alarm" across Moscow...

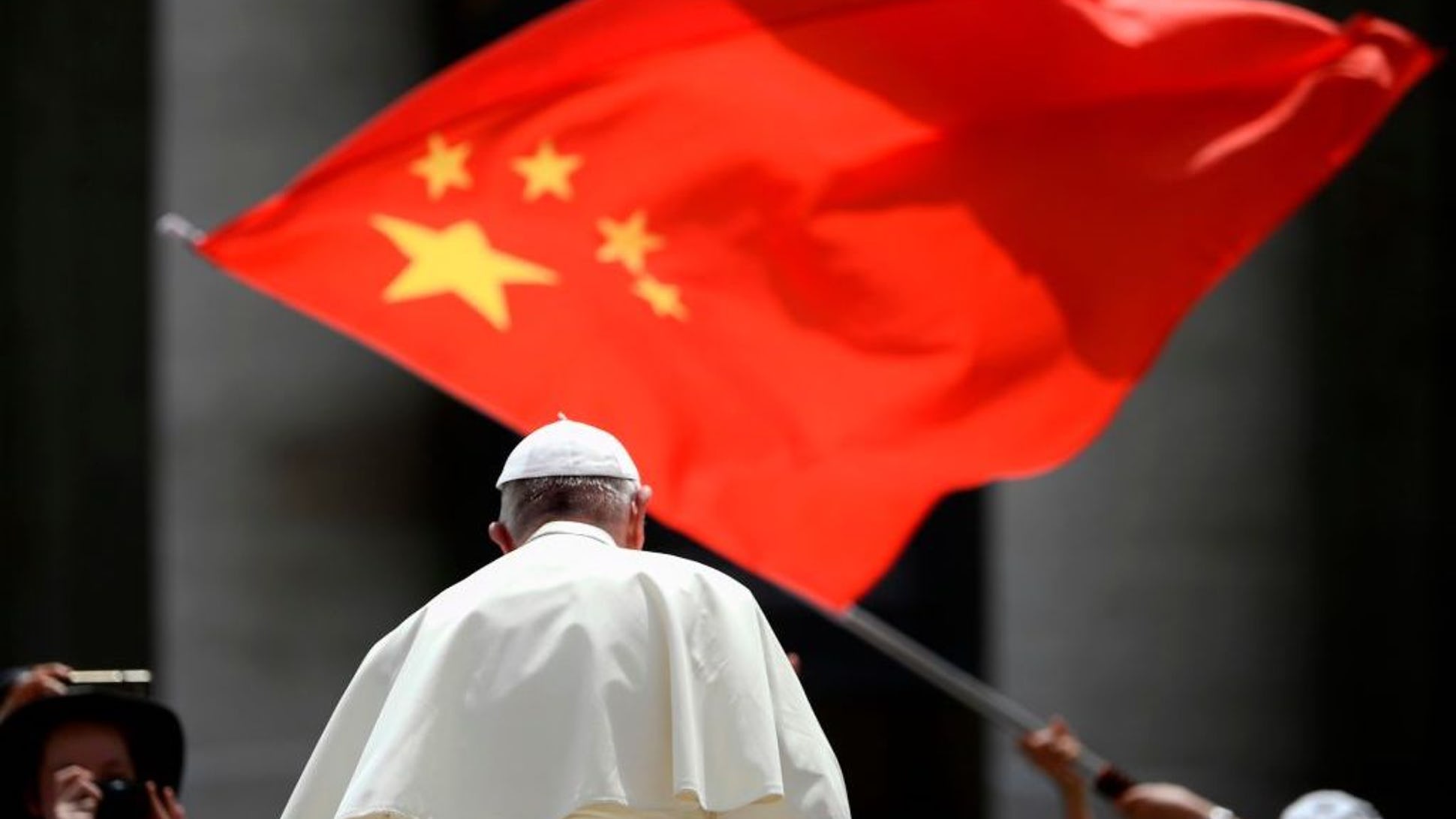

Pope Francis’ Revolution: The Synod on Synodality

the Catholic Church will tailor doctrine according to parish polling and diocesan plebiscite rather than biblical direction...

The United States Deficit Road To Ruin

This means that the United States will likely post the worst GDP growth excluding debt increases since 1929...

Barack Hussein Obama Criticizes Israel over Gaza…

Obama ignored Israel’s long record as one of the best, if not the best countries in the world...

How Should We Respond to Evil?

Don’t let the dark shadows of anger and fear overcome the light of Christ...