Bill Gates gets $7.5B donation from American taxpayers during pandemic

Natural News: Buried deep in the $1.9 trillion coronavirus relief package signed by President Joe Biden on Thursday, March 11, is a provision to provide a $3.5 billion giveaway to Bill Gates’ Global Fund to Fight AIDS, Tuberculosis and Malaria.

“As for the rich in this present age, charge them not to be haughty, nor to set their hopes on the uncertainty of riches, but on God, who richly provides us with everything to enjoy.” Timothy 6:17 ESV

The organization, simply known as the Global Fund, is an international financing and partnership organization with Gates being one of the first donors to provide seed money. 1

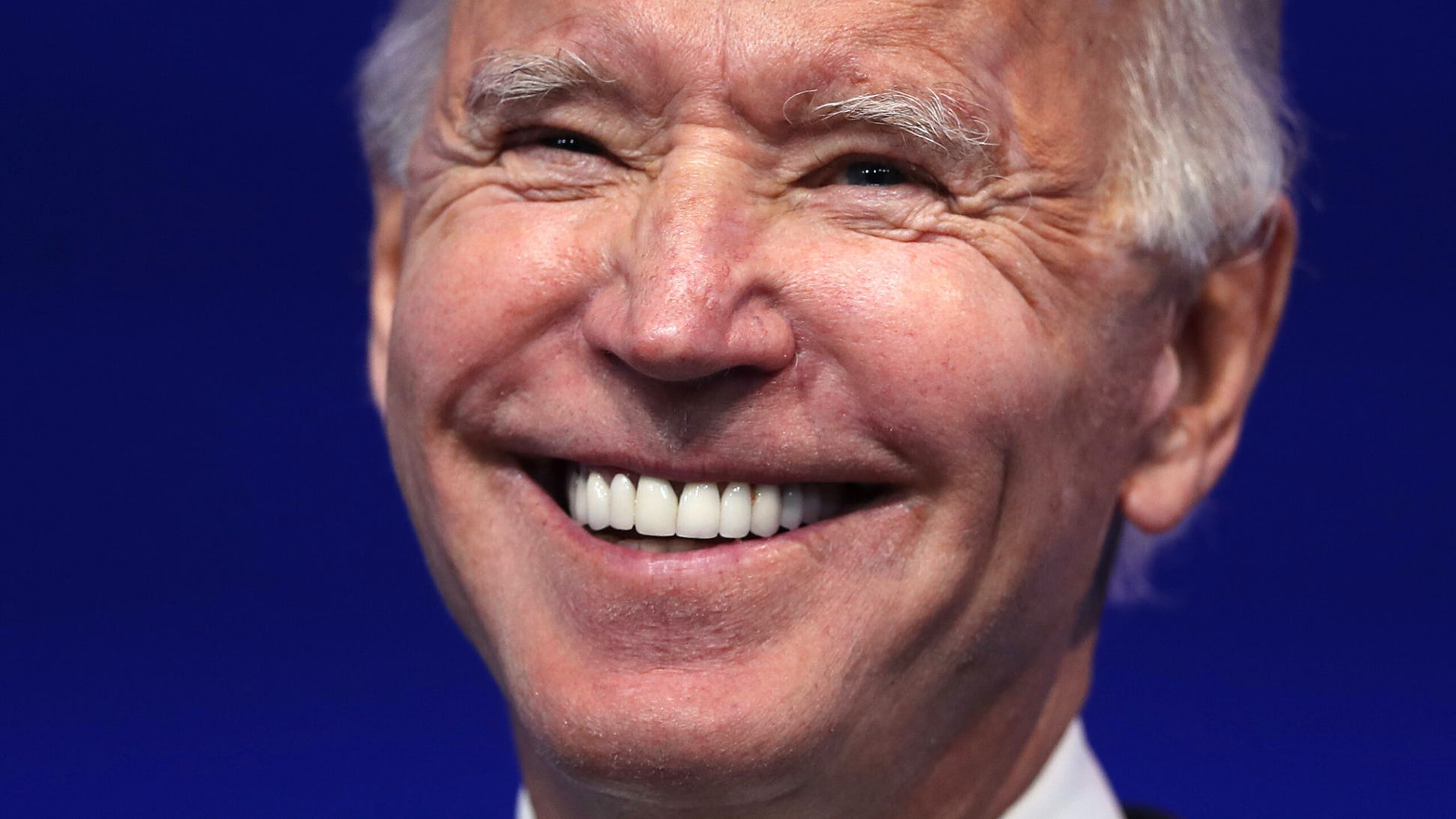

“I believe this is – and most people I think do as well – this historic legislation is about rebuilding the backbone of this country and giving people in this nation, working people, the middle-class folks, people who built the country, a fighting chance,” Biden said as he signed the bill exactly a year after the World Health Organization (WHO) declared a pandemic.

With a net worth of $126 billion, Gates doesn’t fit the profile of a middle-class folk.

The provision found on page 613 of the package stated: “$3,750,000,000 to be made available to the Department of State to support programs for the prevention, treatment and control of HIV/AIDS in order to prevent, prepare for and respond to coronavirus, including to mitigate the impact on such programs, of which not less than $3,500,000,000 shall be for a United States contribution to the Global Fund to Fight AIDS, Tuberculosis and Malaria.”

Critics may point out that most of the Global Fund’s projects are international, which defeats the purpose of the package known as the American Rescue Plan. Read More